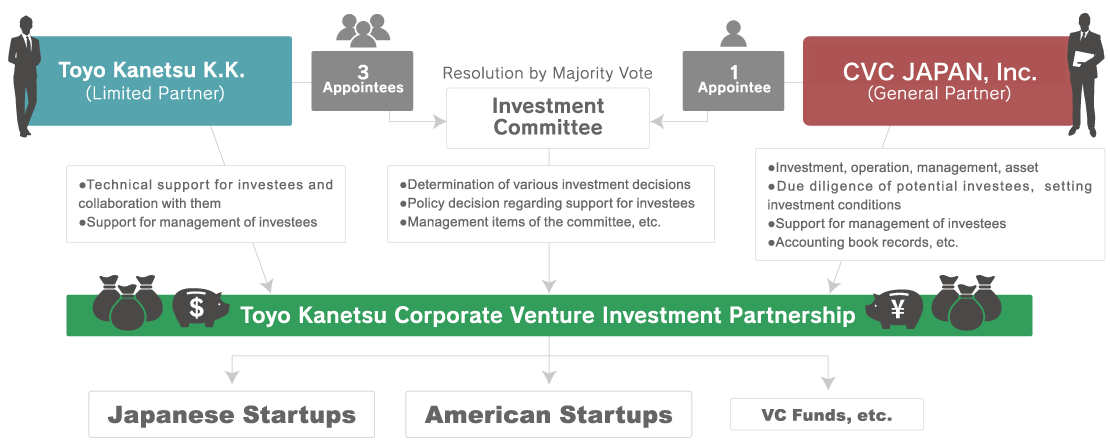

- The Toyo Kanetsu Corporate Venture Investment Partnership (TKCV) is a corporate venture capital fund established by Toyo Kanetsu K.K.(listed on the 1st section of the Tokyo Stock Exchange) in October 2017. And Toyo Kanetsu Corporate Venture Fund Ⅱ(TKCVⅡ) was also established by the company in October 2018.

- As a general partner (GP), TC Consulting, Inc. acts to search, review, invest, and follow-up to investee companies. Toyo Kanetsu K.K., a limited partner (LP), is also partially responsible for these tasks.

TC Consulting’s Corporate Web - We vigorously promote open innovation and collaborate with startup companies to aim for the launch of new business that will lead to future prospects.

Let’s Join into an Alliance with Toyo Kanetsu Group!

TKCV will actively invest in private equity!

Currently, we are looking for startups that will collaborate with the Toyo Kanetsu Group to develop new products, new services, and new business!

Sorter Systems

Sorter Systems Automatic Case Storage Systems

Automatic Case Storage Systems BHS(Check-in Counter)

BHS(Check-in Counter) BHS(Baggage Claim)

BHS(Baggage Claim)

Small Winch

Small Winch Apartment Housing

Apartment Housing Asbestos Inspection

Asbestos Inspection